Asistam la lupta dintre tribul tare si tribul slab… tribul tare are acces la informatii si scapa ieftin iar tribul slab sta acasa neinformat si la urma isi vede pierdute depunerile…

Criza din Cipru nu s-a terminat ci abia începe

Troica incompetenţilor, de la FMI Comisia Europeană şi Banca Centrală Europeană se pregăteşte de ce-i mai rău după ce a făcut gafa de proporţii istorice de-a propune confiscarea din depozitele garantate.

Inepţia a picat testul democratic, fiind respinsă de Parlament. Apoi, a venit „planul B” – tunsoarea depozitelor negarantate de la principalele două bănci, care şi-a propus să ocolească Parlamentul dar să păstreze bizara ordine de precedenţă care arde depunătorii dar protejează creditorii băncilor. Ei bine, este foarte posibil ca eurocraţia să aibă o nouă surpriză neplăcută, de data asta din partea Justiţiei. Cam toată lumea dă în judecată Ciprul, începând cu „oligarhii ruşi” şi biserica ortodoxă şi ajungând până la… oricine altcineva.

Şi au toate argumentele să o facă cu succes – în procedura normală de faliment, ordinea de precedenţă e una simplă şi clară: mai întâi se îndestulează depunătorii, dacă mai rămâne ceva se împarte între creditori (la rândul lor aflaţi într-o ierarhie de seniorităţi), iar dacă mai rămâne ceva – se împarte între acţionari. Troica a încercat cu disperare să evite această ordine, făcând prioritare bondurile senior dar şi liniile de finanţare de la BCE, chiar cu preţul tăierii din depozite. Motivul a devenit limpede în momentul anunţului că Laiki se transformă în „banca rea” iar Bank of Cyprus rămâne „banca bună”, cu schimbul aferent de active. Bank of Cyprus preia, printre altele, 9 miliarde de euro (!) datorie la BCE, în contul ajutorului de urgenţă cu lichiditate (ELA), pe lângă miliardul pe care îl are deja.

Aşadar, troica contribuie cu zece miliarde de euro la „salvarea” ciprului doar pentru ca Ciprul să aibă de unde da 10 miliarde de euro înapoi, în timp ce pierderile băncilor sunt suportate din depozitele clienţilor. Proastă afacere pentru ciprioţi.

Au riscat investind în obligaţiuni greceşti şi trebuie să îşi asume pierderea, se poate argumenta – în mod absolut corect. Dar exact acelaşi lucru a făcut şi Banca Centrală Europeană! A riscat creditând Cipru, care investise în obligaţiuni greceşti iar acum… trebuie să îşi asume pierderea. Lucru pe care, aşa cum am constatat, îl evită cu disperare.

Deci opţiunea „nucleară” a Ciprului este să lase băncile falite să cadă conform procedurii legale, despăgubindu-i integral pe depunători şi trimiţând doar calde salutări către domnul Draghi.

Sigur, o încetare de plăţi către Banca Centrală Europeană înseamnă ieşirea de facto din zona euro. Însă ciprioţii nu au nimic de pierdut – în momentul acesta euro cipriot este o monedă aparte. În primul rând, un euro din bancă este mai ieftin decât un euro cash, pentru că nu poate fi retras la discreţia proprietarului. Apoi, un euro cash din Cipru este mai ieftin decât un euro cas de oriunde altundeva, pentru că scoaterea lui din ţară este ilegală, sub sancţiunea confiscării, deci scumpă în sine. Practic, Cipru are în acest moment toate dezavantajele şi nici un avantaj al euro. Totuşi, asta nu va împiedica ţara să folosească moneda în continuare – „clandestin” – după modelul Muntenegru sau Kosovo, .

Iar dacă erau indecişi, politicienii europeni şi locali au reuşit să pună paie pe foc: Pe lângă ordinea dubioasă de precedenţă, sucursalele băncilor greceşti au fost scutite de restricţii, discriminare nejustificată şi greu de acceptat după ce Cipru acceptase docil tăierea de 80% din datoriile Greciei, impusă tot de troică. Apoi a venit informaţia că deponenţii ruşi şi englezi şi-au putut retrage banii de la sucursalele din Moscova respectiv Londra. Apoi, că familia preşedintelui a scos din ţară 20 de milioane de euro cu o săptămână înainte de primul anunţ. Asta mai era de batjocorit după democraţie şi justiţie – bunul-simţ.

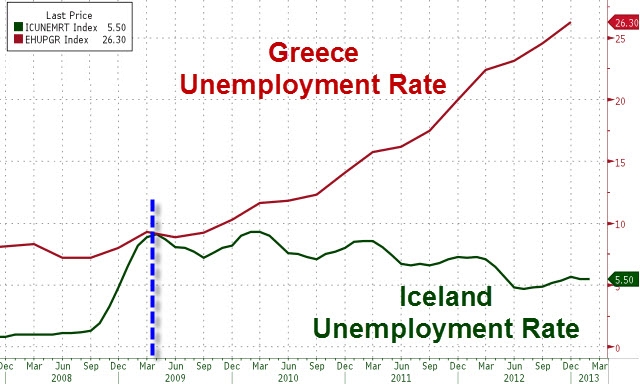

Cipru are ales acum dacă să o ia pe drumul Greciei sau al Islandei, iar toate argumentele atârnă într-o singură parte.

7 comentarii

FNI era copil!

Luciane, eu sunt convins ca baietii de la UE au avut acoperire juridica pt. inversare ordinii „indestularii” creantelor 🙂

Nu uita, legea este reflectare a starii de fapt, nu invers :).

Asta nu inseamna ca dreptul anglo saxon, cu obsesia precendentelor, este mai unfair decat cel frantuz :). Cu siguranta e mai putin ipocrit.

Legea. Nu. A. Fost. Aplicată.

Practic la ora actuala, Cipru nu mai are nimic de pierdut.

Probleme in Paradis

http://lucianfanea.blogspot.ro/2013/04/probleme-in-paradis.html

I am writing to update you on the economic and banking system developments in Cyprus following the Eurogroup decisions of last March and to request your support regarding a number of very pressing issues which need to be addressed the soonest.

1. The Cypriot economy is adapting to major shocks

The Cypriot economy is adapting to major shocks. Substantial private wealth has been lost and a significant number of Cypriot firms have lost their working capital at the two systemically important financial institutions which were subject to the bail – in. Restrictive measures, including capital controls, are seriously hampering the conduct of business and confidence in the banking system has been shaken. As a result the economy is driven into a deep recession, leading to a further rise in unemployment and making fiscal consolidation all the more difficult.

2. Application of bail-in was implemented without careful preparation

It is my humble submission that the bail-in was implemented without careful preparation. Its form was changed drastically within a week. Originally designed as a general bail-in across the banking system, it eventually became focused on the two distressed banks, the Laiki Bank and the Bank of Cyprus (BOC). There was no clear understanding of how a bail-in was to be implemented, legal issues are being raised and major delays in completing the process are being observed. Moreover, no distinction was made between long-term deposits earning high returns and money flowing through current accounts, such as firms’ working capital. This amounted to a significant loss of working capital for businesses. An alternative, Ionger-term, downsizing of the banking system away from publicity and without bank-runs was a credible alternative that would not have produced such a deep recession and loss of confidence in the banking system.

3. Cyprus was forced to pay the cost to ring-fence Greece but no reciprocity has been granted

Another feature of the current solution was that deposits at the branches of Laiki and Bank of Cyprus in Greece were spared from a haircut to prevent contagion. These deposits amounted to €15 billion. The wish to avoid contagion to Greece was also evident in the Eurogroup’s insistence that Cypriot banks sell their Greek branches. In addition and as a result of the sale, the Cypriot banks have lost their Greek deferred tax assets. As understandable as ring-fencing may be, this was absent at the time of deciding the Greek PSI in relation to the Greek Government Bonds which cost Cyprus 25% of its GDP (€4.5 billion). The heavy burden placed on Cyprus by the restructuring of Greek debt was not taken into consideration when it was Cyprus’ turn to seek help.

4. Imposition of Laiki’s ELA liability to Bank of Cyprus

The implementation of the sale of the Greek branches of the Cypriot banks, as urged by the Eurogroup, resulted in Laiki selling assets that were pledged against its ELA liability to Piraeus Bank, without Piraeus assuming the corresponding ELA liability. As such, Laiki was left with the related ELA liability but without the aforementioned assets. The ELA liability which was left „unsecured” as a result of the sale amounts to around €3.8 billion and was imposed on Bank of Cyprus as a result of the Eurogroup decision. It is worth reminding that a substantial part (in excess of €4 billion) of Laiki’s ELA liability was required in the first place in order to cover deposit outflows experienced by Laiki’s Greek branches.

Bank of Cyprus itself has a total ELA liability of around €2 billion. By taking an additional €9 billion from Laiki, which was accumulated over the course of the last year under very questionable circumstances, BOC has substantially increased the vulnerability of its own funding structure, with its cumulative ELA liability reaching a very high €11 billion. BOC was called to pledge its own assets to cover for the collateral shortfall for the €3.8 billion liability carried over by Laiki. Such a high amount of ELA liability hinders BOC’s funding sources as the room for obtaining additional ELA is limited. The imposition of Laiki’s ELA liability on Bank of Cyprus is the main contributor to the liquidity strain Bank of Cyprus faces.

5. Urgent need for Troika to provide a long-term sustainable and viable solution to the liquidity issues Bank of Cyprus is facing as a result of the Eurogroup decisions

Instead of addressing the issue of severe liquidity strain on Cyprus’ mega-systemic bank through a long-term sustainable and viable solution, the Troika partners seem to have chosen the path of maintaining strict capital restrictions. Artificial measures such as capital restrictions may seem to prevent a bank run in the short term but will only aggravate the depositors the longer they persist. Rather than creating confidence in the banking system they are eroding it by the day. Maintaining capital restrictions for a long period will inevitably have devastating effects on the local economy, will also affect the country’s international business and will have an adverse impact on GDP. Under such scenarios spillover effects will no doubt register on other local banks through higher non-performing loans as a result of dampened economic activity. In addition, increased deposit withdrawals from other local banks, as fear of lack of liquidity of the only systemic bank will have a domino effect on the entire banking system.

I stress the systemic importance of BOC, not only in terms of the banking system but also for the entire economy. The success of the programme approved by the Eurogroup and the Troika depends upon the emergence of a strong and viable BOC. It is for this reason that I urge you to support a long-term solution to Bank of Cyprus’ thin liquidity position. Such a solution will re-instate depositor confidence in the banking system and will allow the full functioning of the economy away from restrictive measures and capital controls. It will also facilitate the attraction of foreign direct investment in Cyprus.

My Finance Minister has alerted the Troika Mission Chiefs in writing on 19 May 2013, in relation to the need to implement a long-term viable solution to Bank of Cyprus’ liquidity position. No response has been received yet.

A possible long-term solution could be the conversion of part of Laiki’s ELA liability into long term bonds and the transfer of these bonds and corresponding assets into a separate vehicle. Another solution could be the reversal of the Eurogroup decision in relation to the merger of Good Laiki (carrying the €9 billion ELA liability) into Bank of Cyprus. In any case the BOC should exit resolution status without any further delays and should be granted eligible counter-party status by the ECB. Of course more options need to be examined. I should mention that an interim Board and an interim CEO is already in place at BOC and the final asset valuation is progressing according to schedule.

I urge you to review the possibilities in order to determine a viable prospect for Cyprus and its people. The new government of Cyprus, despite its expressed disagreements, has abided by the Eurozone decisions and remains determined to implement the programme fully and effectively. I am personally determined to lead Cyprus out of this dire situation and towards a path of sustainable growth and development. We are also fully committed to reestablishing Cyprus’s stance as a credible EU partner. However, at this crucial juncture, we are calling upon you for active and tangible support.

http://www.stockwatch.com.cy/nqcontent.cfm?a_name=news_view&ann_id=175990